Bybit

Bybit9.6

A relatively young exchange which was created in the early 2018. However, despite the fact that Bybit is the youngest exchange in our rating, it still has one of the highest liquidity level. Bybit is a direct competitor to Bitmex, but the first one surpasses the second in almost every aspect.

In our personal opinion, Bybit is the best exchange for margin trading. Why? User-friendly interface, a useful mobile app for iOS and Android, high level of liquidity, no KYC requirements – everything we like was included in this exchange.

- No KYC required

- Advanced app for iOS/Android

- No overloads and lags

- Great customer support

- Relatively high fees

- Small coin variety

- Security 9.5/10

- Liquidity 8.5/10

- Fees 9/10

- Coin Variety 9/10

- UI/UX 9.5/10

Fees & Leverage

There are two types of commissions: maker and taker. “Maker” is used when a trader makes an order, and “taker” when it is executed. When you use perpetual swaps, every 8 hours between traders funding processed — someone pays money to you or you have to pay. If you play “short”, while most of the traders hold “long” — then they pay you. If you are in the “long” as the majority, then you pay.

| Perpetual Contracts (inverse) | Highest leverage | Maker Fee | Taker Fees |

|---|---|---|---|

| BTC/USD | 100x | -0.0250% | 0.0750% |

| ETH/USD | 50x | -0.0250% | 0.0750% |

| XRP/USD | 50x | -0.0250% | 0.0750% |

| EOS/USD | 50x | -0.0250% | 0.0750% |

| BTC/USDT | 100x | -0.0250% | 0.0750% |

Interface

- 1. The main info tab

- 2. The display area of candlestick chart

- 3. The display area of the order book

- 4. The display of the latest completed trades

- 5. Open orders of the user

- 6. The display area with the user portfolio overview

- 7. The display area where you can make an order

- 8. The display area with contract details

- 9. The display area with current markets activity

- 10. The display area with additional information

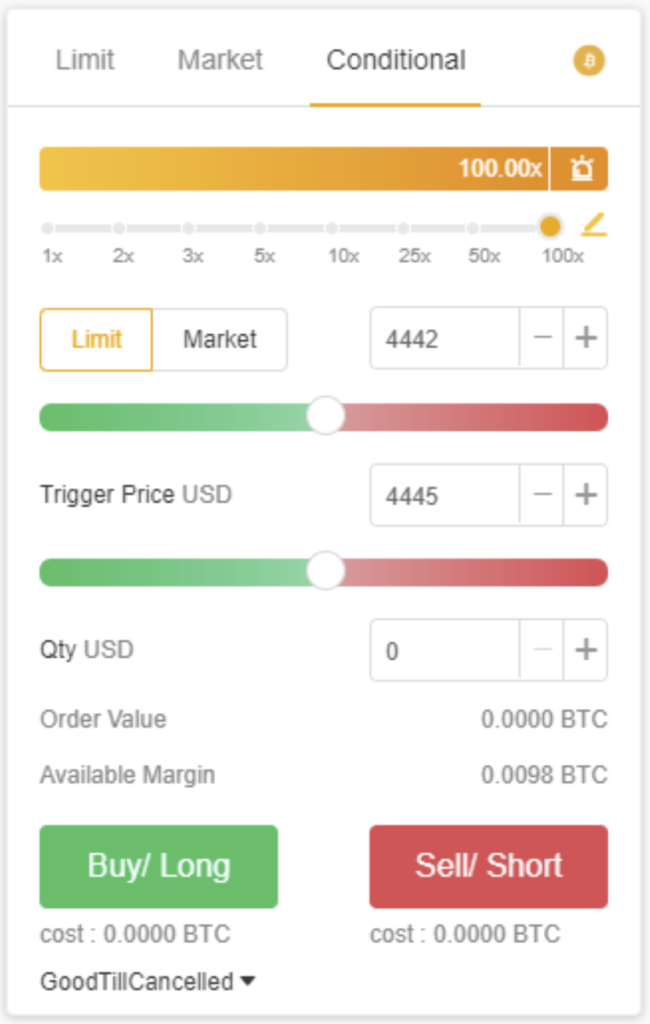

Order Types

Market order

The market order will be executed at the best price available in the order book at the execution time. Traders do not need to set the price which allows the order to be immediately executed. When traders need to enter or exit a volatile fast-moving price market, market orders are generally used.

Limit order

Limit Order allows traders to set the order price, and the order will be filled at the order price or an executed price better than the order price. The advantage of a limit order is that it can guarantee the transaction at the specified price, but it also faces the risk of the order failing to be executed.

Conditional Orders

They are advanced orders that submit automatically once specified criteria are met, namely a trigger price.

Once the preset trigger price meets the Last traded price, a conditional market order will be filled immediately, while a conditional limit order will be submitted to the order book and pending for execution. This limit order will, then, only be filled once the last traded price reaches the preset order price.

Let’s look at an example to see how conditional orders can be used to mimic common order types.

• For Stop-Entry Orders

By using Stop-Entry Orders, traders are able to trade a breakout on the market. On Bybit, traders can use a Conditional Market or Conditional Limit Order to set up a Stop Entry Order. For buy Stop Orders, the trigger price must be higher than the last traded price, while for sell stop orders, the trigger price must be lower than the last traded price.

• For Stop Loss Orders

A Stop Loss order is an instruction to close your position to limit the loss. It is exactly the same as a Stop-Entry Order but is used as an exit option by traders. By using a conditional order, we can customize the stop loss order as a stop loss market order or stop limit order and have the flexibility to partially close a position.

• For Take Profit Orders

A Take Profit Order is an order that closes a position once it reaches a certain level of profit. As mentioned earlier, it can be achieved through Limit Orders. But how to take profit by partially closing an existing position with a market order? To do this, use a Conditional Market Order with a trigger price set to be better than the current last traded price along with the desired quantity of contracts. Take Profit Orders are commonly used as an exit option, but can also be customized as an advanced entry order on Bybit’s platform.

Useful information about the exchange

- 1. For security reasons, Bybit exchange processes withdrawals with the manual review three times a day at 8:00, 16:00 and 24:00 UTC.

- 2. In the the upper right corner of the “Place Order” tab, you can find a small icon of a calculator. There you can count your profit/loss and liquidating price using different data.

- 3. You don’t need to send your personal data (photo of the passport) to the exchange’s support. You can deposit, withdrawal and trade without any limits right after the essential registration.

- 4. Bybit has no minimum deposit limit. However, there are minimum withdrawal limits

| Coin | Min deposit | Min withdrawal | Minerer free |

|---|---|---|---|

| BTC | No minimum | 0.002BTC | 0.0005BTC |

| ETH | No minimum | 0.02ETH | 0.01ETH |

| EOS | No minimum | 0.2EOS | 0.1EOS |

| XRP | No minimum | 20XRP | 0.25XRP |

| USDT | No minimum | 50 USDT | 2 USDT |