Binance

Binance9.6

As we have already said, It’s fair to say that Binance is the leading crypto exchange according to the opinion of the whole crypto community. The best choice for beginners: intuitive interface, fiat depositing options, large coin variety, one of the highest levels of security between crypto exchanges and small fees.

The main secret of success of this exchange is continuous development. At the moment Binance can offer you a big range of services: more than 150 cryptocurrencies are available for trading. Moreover, there you can trade major crypto assets such as Bitcoin with leverage up to 125x.

- High level of liquidity

- No KYC required

- Highly Secure Storage

- More than 150+ coins for trading

- Advanced app for iOS/Android

- Great customer support

- No overloads or lags

- Some coins have a low level of liquidity because of which they are often used in Pump&Dump scam actions

- Futures trading requires full KYC

- Margin trading interface can be difficult for beginners

- Security 10/10

- Liquidity 9.5/10

- Fees 9.5/10

- Coin Variety 10/10

- UI/UX 9/10

Binance is the large exchange which offers a number of different trading instruments: spot trading, margin trading, futures trading. The only thing you need to work with these tools is cryptocurrency in your wallet. Here is our guide on how to easily buy cryptocurrencies using Binance.

SPOT TRADING (CLASSIC)

1. To start trading, first of all choose the market you want to work with. The easiest way of doing so is to click on the “Markets” button at the top of the website.

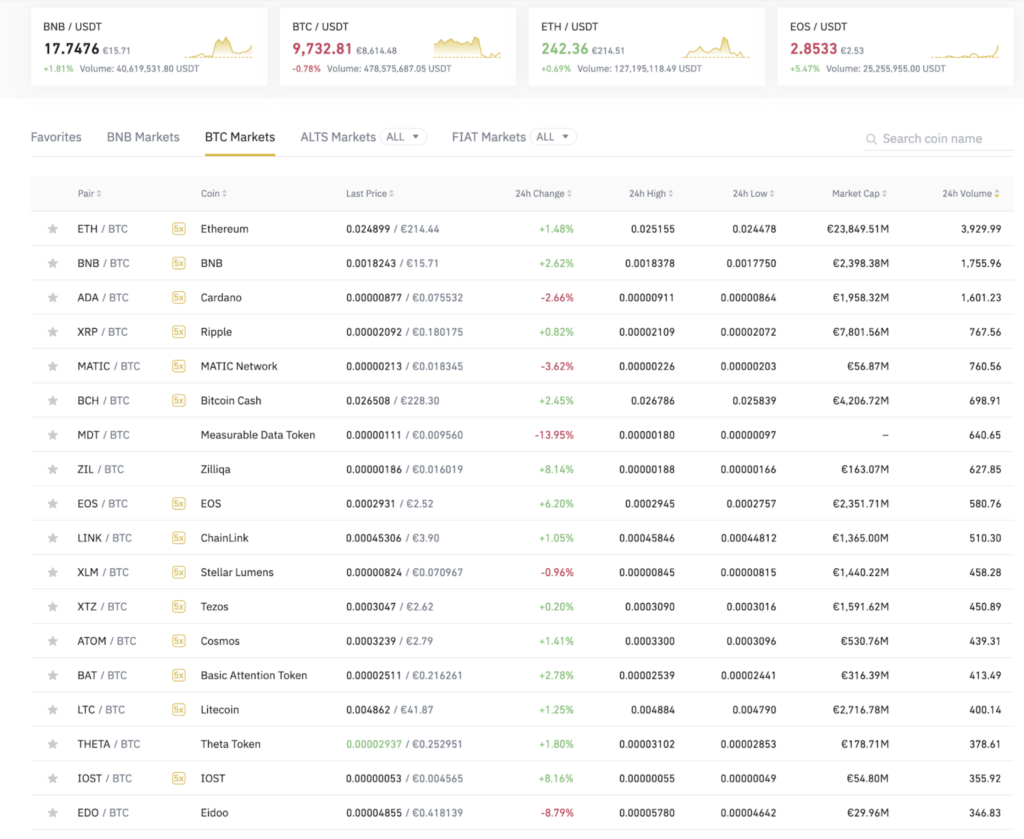

2. There you are able to choose the market for work. For example, if you want to purchase BNB at the current bitcoin price, choose BTC Market and input BNB in the search box. By clicking the trading pair BNB/BTC, the corresponding trading page will be displayed.

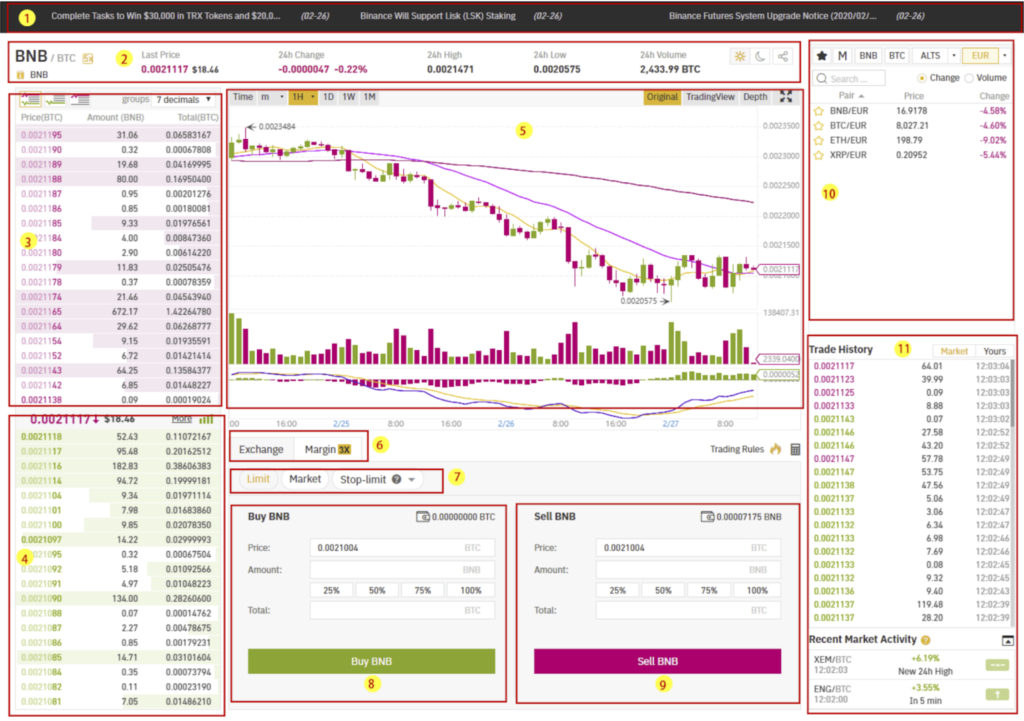

3. Appearance of the trading page

- 1. The area of Binance Announcements

- 2. The area of the current trading pair in 24h Volume

- 3. The area of sell order book

- 4. The area of buy order book

- 5. The area of candlestick chart and Market Depth

- 6. Spot trading or Margin trading

- 7. The type of order

- 8. The buy area

- 9. The sell area

- 10. The switch area of other trading markets/trading pairs

- 11. The display of the latest completed transaction price

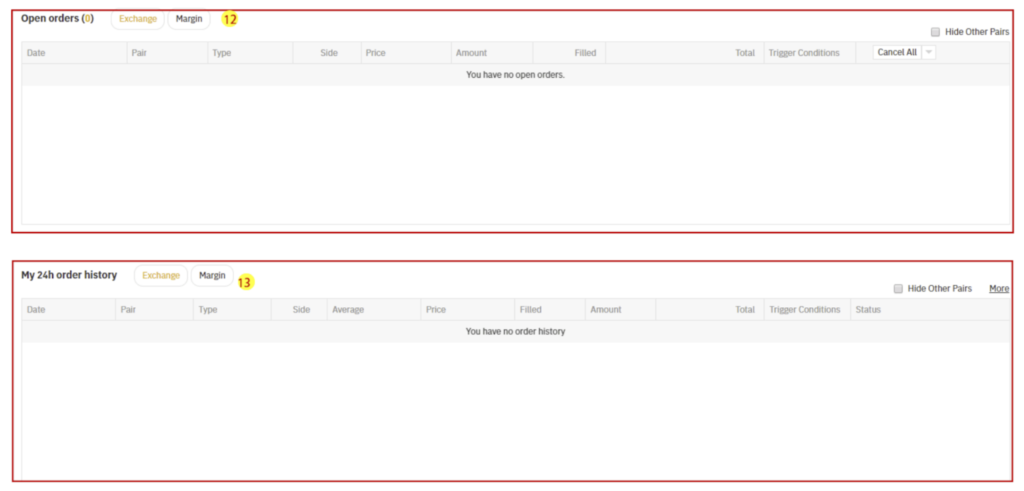

- 11. Open orders of the user

- 12. Order history of the user

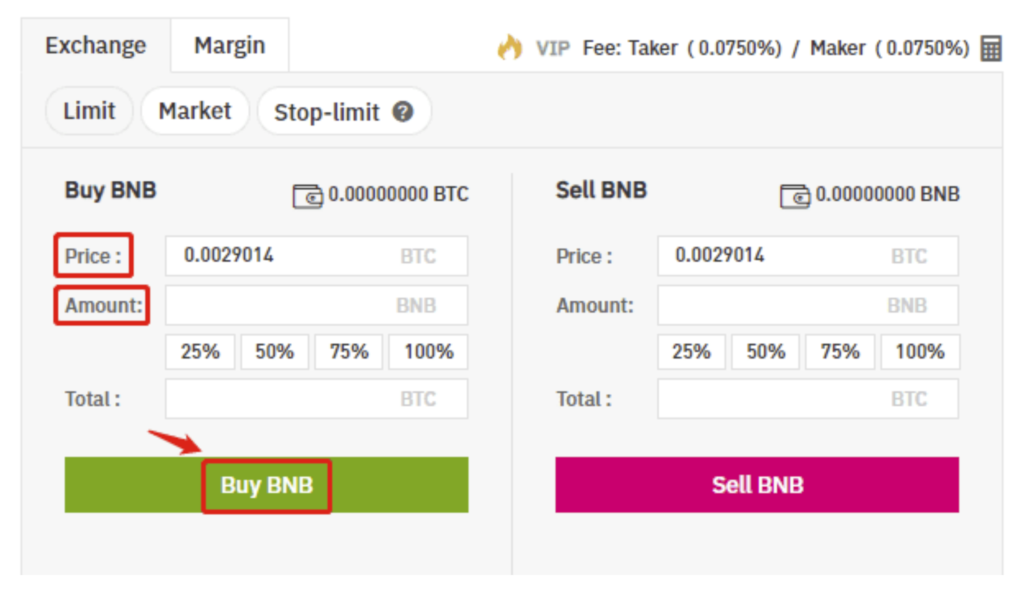

4. Use the buy area of the Basic or Advanced website to buy BNB, or the sell area to sell BNB. Fill in the price and the amount that you prefer to place the order.

MARGIN TRADING

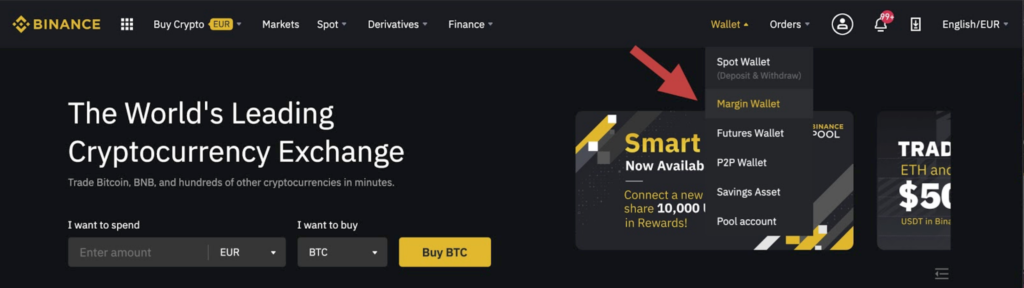

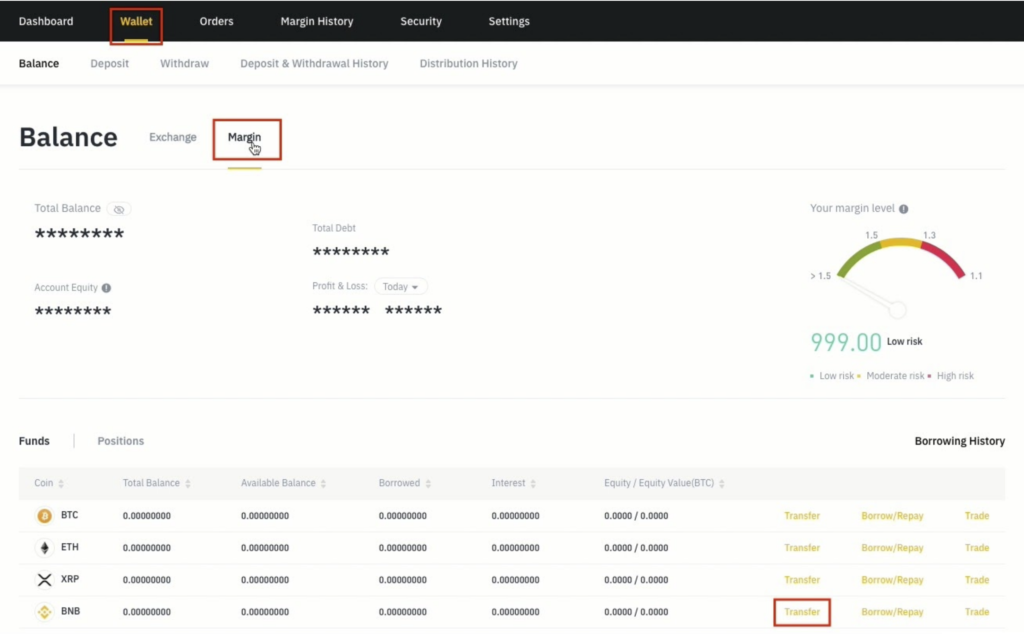

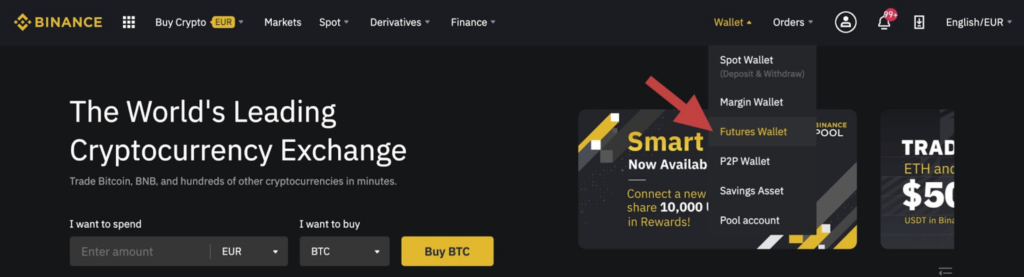

1. To open Margin Account on Binance exchange you have to choose the “Wallet” menu at the top of interface and then click on the “Margin Wallet”.

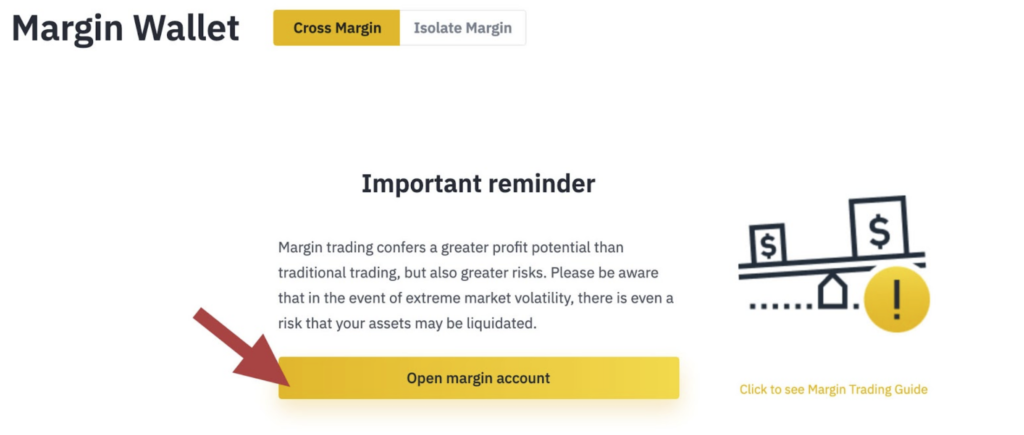

2. There you will see a reminder about the risks of margin trading. Please read it and, if you are willing to proceed, click on the “Open margin account” button.

3. The next step is transferring funds from the spot wallet the margin one. To do so, click on the “Wallet” tab, select “Margin” and click on the “Transfer” button on the right side of the page.

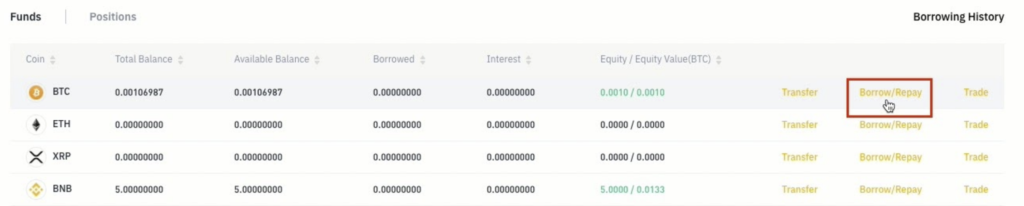

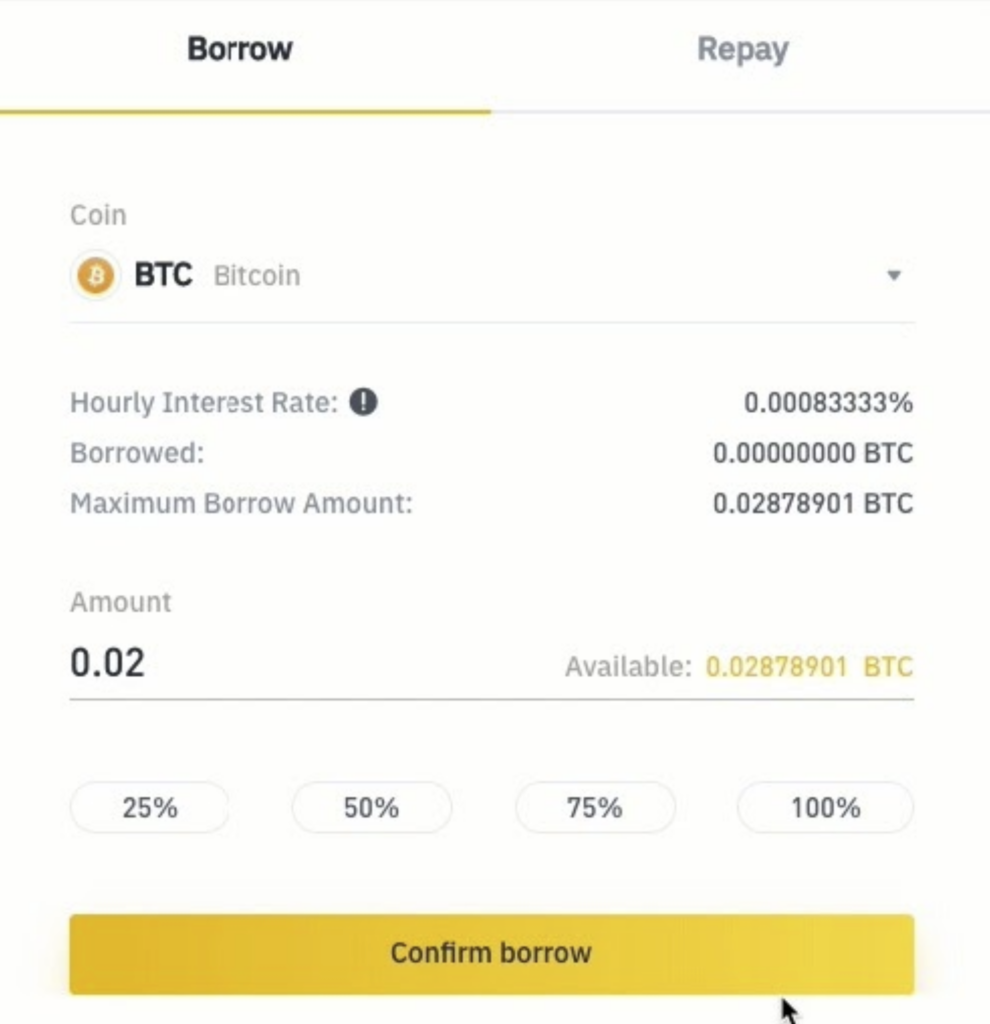

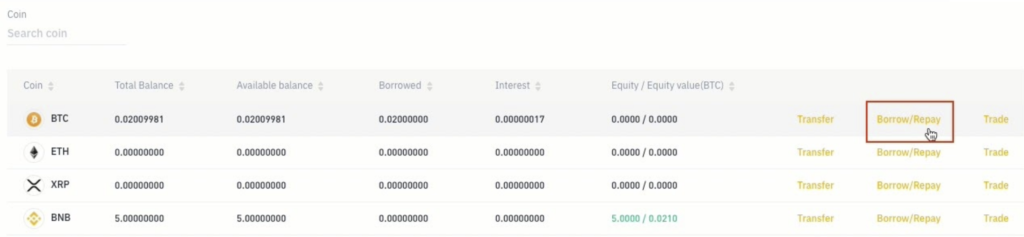

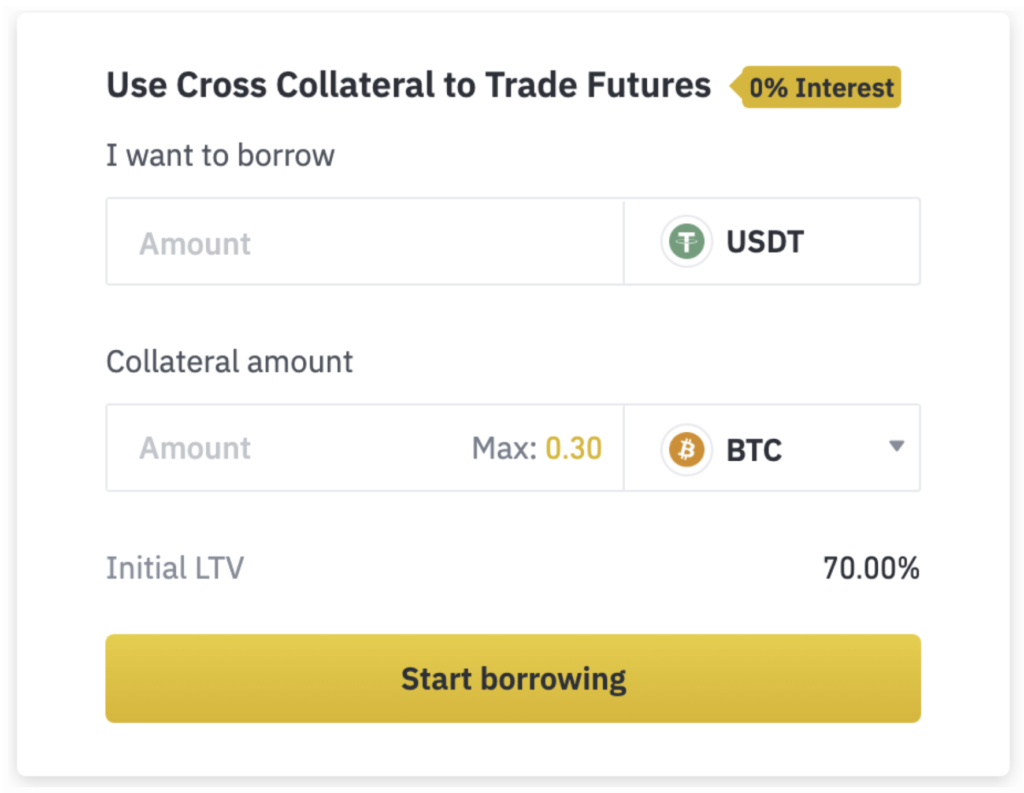

4. Now, when the wallet is created and you have funds there, you will be able to use them as collateral to borrow funds. Your Margin Wallet balance determines the amount of funds you can borrow, following a fixed rate of 5:1 (5x). So if you have 1 BTC, you can borrow 4 more. In this example, we will borrow 0.02 BTC.

5. After selecting the coin you wish to borrow and the amount, click “Confirm borrow.”

6. Next, your margin account will be credited with the Bitcoin you borrowed. You will now be able to trade the borrowed funds while having a debt of 0.02 BTC plus the interest rate. The interest rate is updated every 1 hour. You can check the currently available pairs as well as their rates on the Margin Fee page. You can check your current margin account status by going to your “Wallet Balance” page and selecting the “Margin” tab.

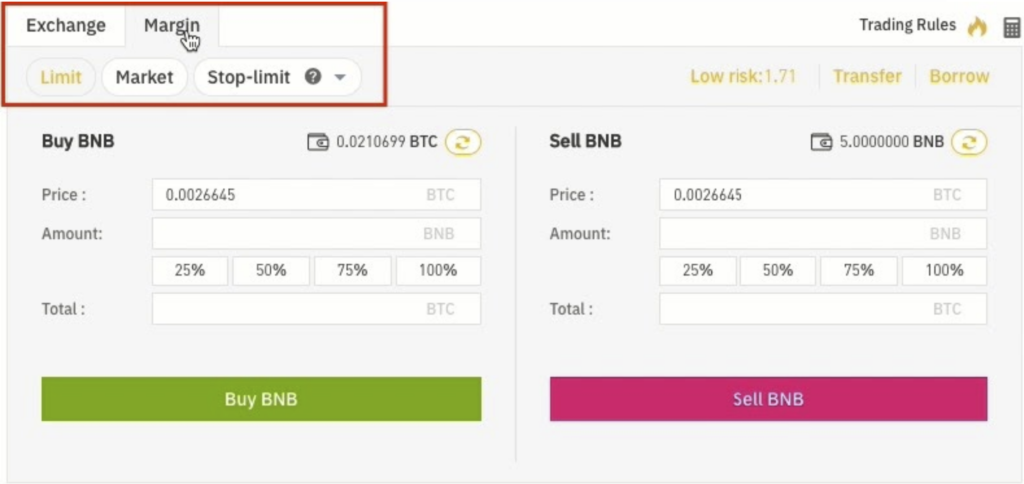

7. If you wish to use your borrowed funds to trade, you can go to the Exchange page, select the “Margin” tab, and trade normally using Limit, Market and Stop-Limit orders.

8. To repay your debt, click on “Borrow/Repay” button and select the “Repay” tab.

FUTURES TRADING

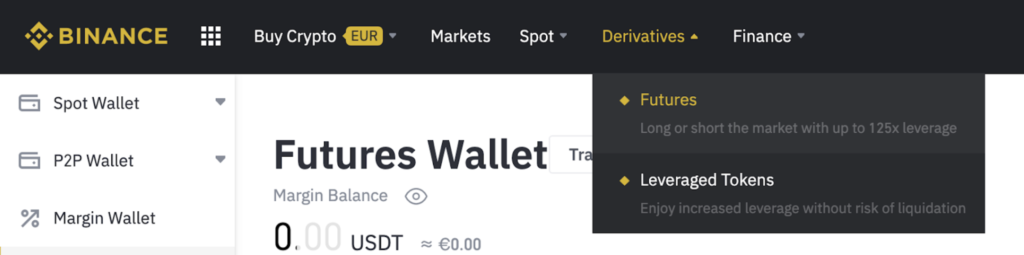

1. To open Futures Account on Binance exchange you have to choose the “Wallet” menu at the top of interface and then click on the “Futures Wallet”.

2. Click on the “Open now” button to activate your Binance Futures account. And that’s it. You’re ready to trade!

3. Now it’s time to fund your Binance Futures Account. You can easily transfer funds back and forth between your Exchange Wallet. Set the amount that you’d like to transfer and click on Confirm transfer. You should be able to see the balance added to your Futures Wallet shortly.

4. Now, when you have funds in your Binance Futures Wallet you can finally start trading. To open a trading panel – choose the “Derivatives” menu at the top of interface and then click on the “Futures”.

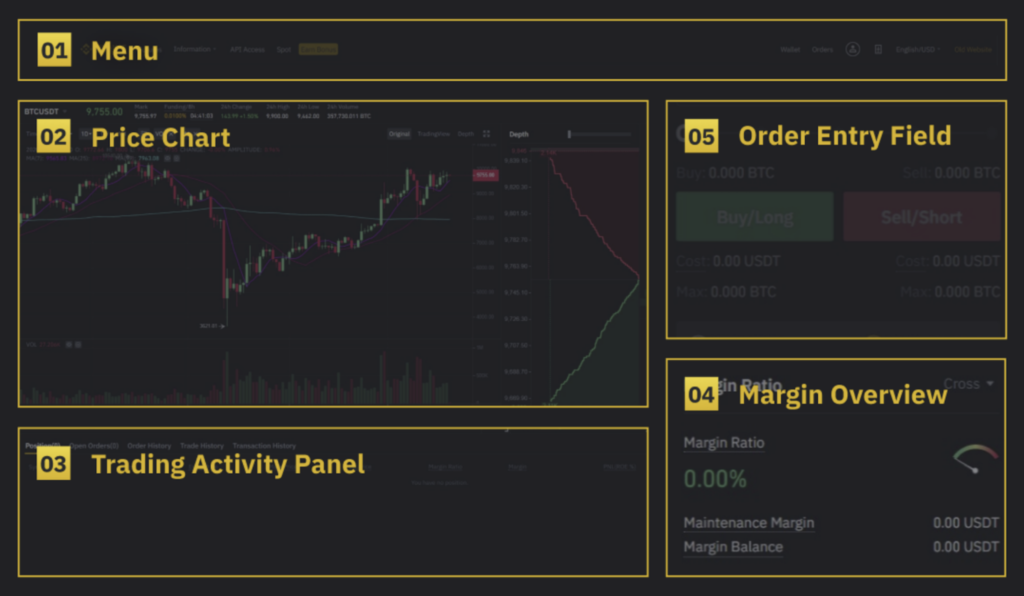

5. Appearence of the trading page

1. On the left side of this area, hover over Information, and get access to a wide variety of detailed market data, visualizations, and the Futures FAQ.

2. Price chart where you can not only see the price behaviour, but also check the expected Funding Rate and a countdown until the next funding round, see live order book data along with a visualization of order depth and check a live feed of previously executed trades on the platform.

3. This is where you can monitor your own trading activity. You can switch between the tabs to check the current status of your positions and your currently open and previously executed orders. You can also get a full trading and transaction history for a given period.

4. This is where you can check your available assets, deposit, and buy more crypto. This is also where you can view information relating to the current contract and your positions. Be sure to keep an eye on the Margin Ratio to prevent liquidations.

5. This is your order entry field. This is also where you can switch between Cross Margin and Isolated Margin. Adjust your leverage by clicking on your current leverage amount (20x by default).

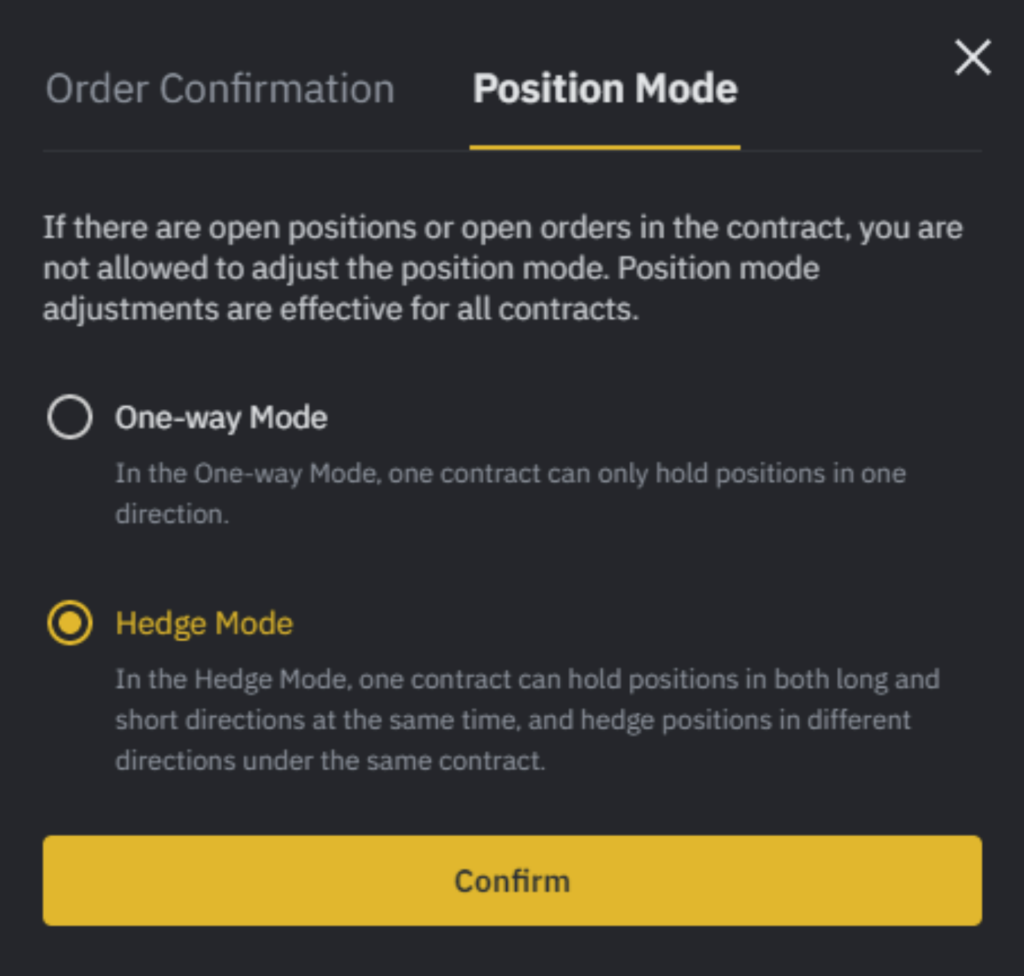

What is Hedge Mode?

In Hedge Mode, you can hold both long and short positions at the same time for a single contract. Why would you want to do that? Well, let’s say you’re bullish on the price of Bitcoin on the longer term, so you have a long position open.

At the same time, you may want to take quick short positions on lower time frames. Hedge Mode allows you to do just that – in this case, your quick short positions won’t affect your long position. So, if you want to use Hedge Mode, you’ll need to enable it manually. Here’s how you do that.

- 1. Hover over your account icon on the top right, and select Preference.

- 2. Select Hedge Mode.

What is Post-Only, Time in Force and Reduce-Only?

When you use limit orders, you can set additional instructions along with your orders. On Binance Futures, these can either be Post-Only or Time in Force (TIF) instructions, and they determine additional characteristics of your limit orders.

You can access them at the bottom of the order entry field. Post–Only means that your order will always be added to the order book first and will never execute against an existing order in the order book. This is useful if you would only like to pay maker fees.

TIF instructions allow you to specify the amount of time that your orders will remain active before they are executed or expired. You can select one of these options for TIF instructions:

- • GTC (Good Till Cancel): The order will remain active until it is either filled or canceled.

- • IOC (Immediate Or Cancel): The order will execute immediately (either fully or partially). If it is only partially executed, the unfilled portion of the order will be canceled.

- • FOK (Fill Or Kill): The order must be fully filled immediately. If not, it won’t be executed at all.

When you’re in One-Way Mode, ticking Reduce–Only will ensure that new orders you set will only decrease, and never increase your currently open positions.

Useful information about the exchange

1. One of the important Binance features is the ability to pay fees in exchange’s coin – BNB. This feature helps users to reduce the number of fees they paid to exchange. Time in the schedule below is calculated since Binance establishment in July 2017, not account registration time.

| Time | The 1st year | The 2nd year | The 3rd year | The 4th year | The 5th year |

|---|---|---|---|---|---|

| Discount rate | 50% | 25% | 25% | 6.75% | No discount |

2. Binance has a matching engine — fast enough to process and sustain 1.4 million transactions every second… making it the world’s fastest cryptocurrency exchange.

3. To start trading futures users must have an advanced account with completed KYC registration

4. There is also an opportunity to convert small balances of altcoins into Binance Coin

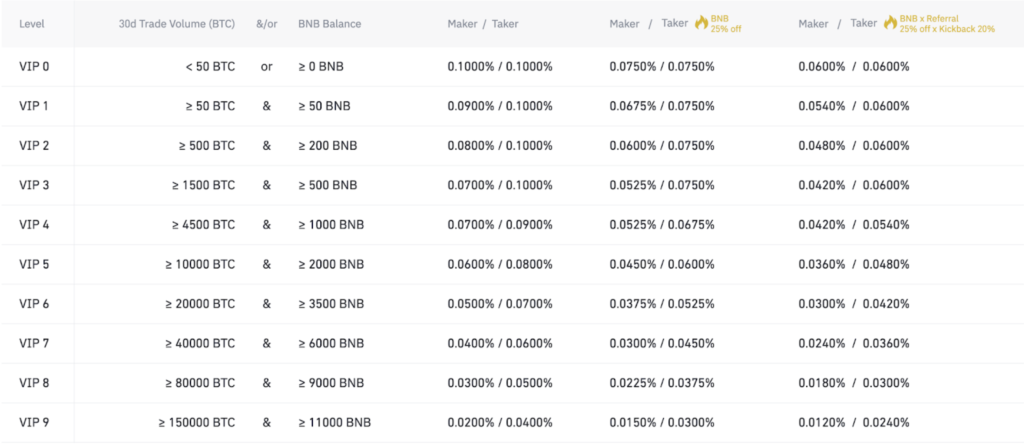

5. There is a multi-level fee system. The level is defined by the monthly trade volume and amount of BNB coins a user holds